Printable Sales Tax Table

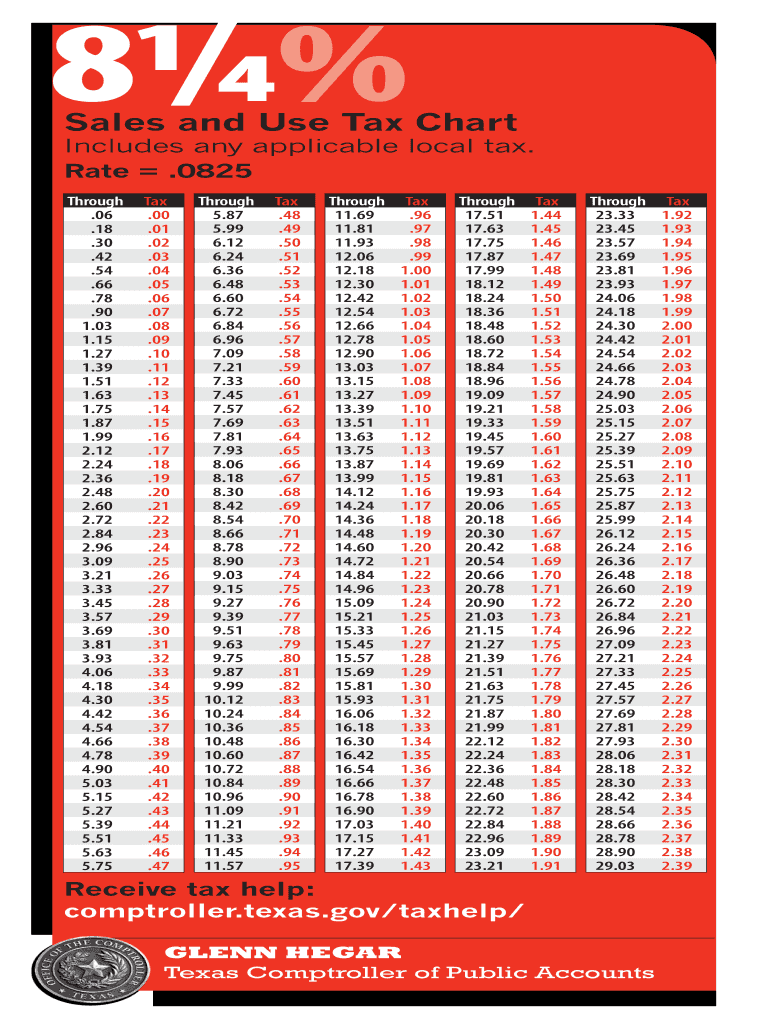

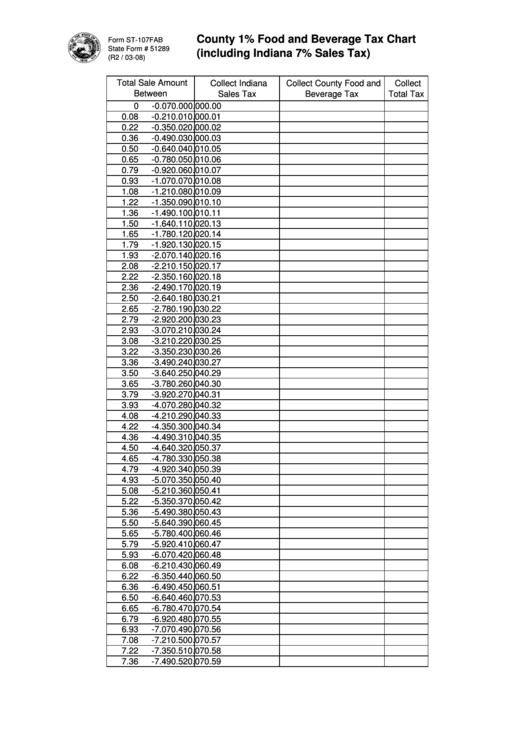

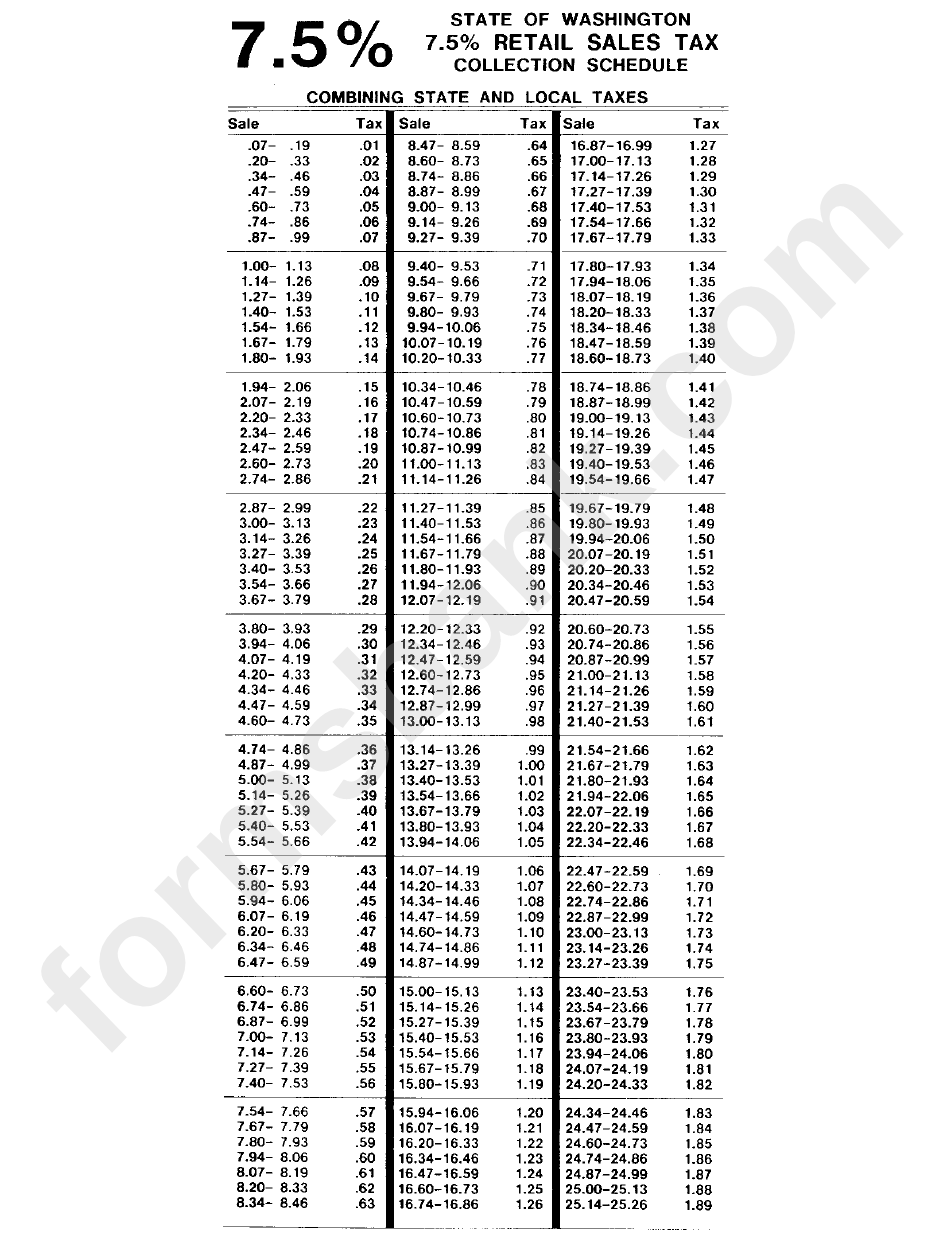

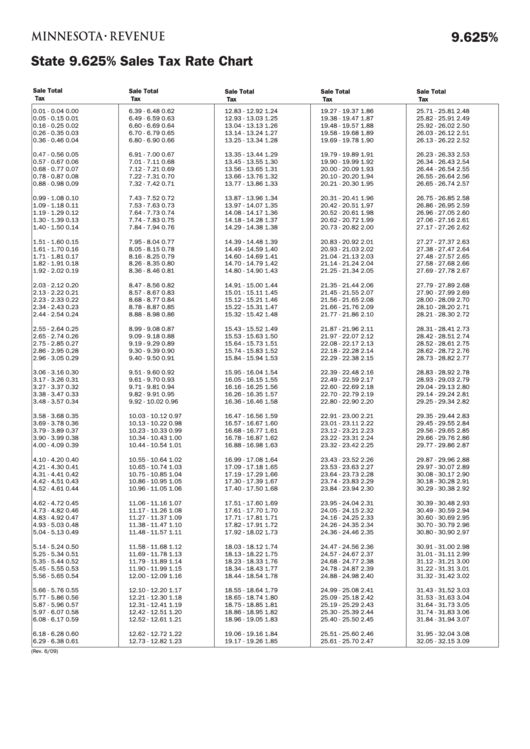

Printable Sales Tax Table - Download sales tax rate tables for any state for free. This is a printable illinois sales tax table, by sale amount, which can be customized by sales tax rate. Effective january 1, 2025, certain taxing jurisdictions have imposed a local sales tax or changed their local sales tax rate on general merchandise sales. In illinois, occupation and use taxes are collectively referred to as “sales tax.” the retailers’ occupation tax act imposes a tax upon persons engaged in this state in the business of. Listed below by county are the total (4.75% state rate plus applicable local and transit rates) sales and use tax rates.note: These rates do not include any prepared meal taxes imposed and. Find the 2025 tax rates (for money you earn in 2025). See current federal tax brackets and rates based on your income and filing status. This is a printable illinois sales tax table, by sale amount, which can be customized by sales tax rate. This chart can be used to easily calculate illinois sales taxes. The 10.25% sales tax rate in chicago consists of 6.25% illinois state sales tax, 1.75% cook county sales tax, 1.25% chicago tax and 1% special tax. These charts can serve as handy references in your day to day sales and use tax work. This chart can be used to easily calculate illinois sales taxes. 7% sales and use tax chart that is free to print and use. Listed below by county are the total (4.75% state rate plus applicable local and transit rates) sales and use tax rates.note: Effective january 1, 2021, remote retailers, as defined in section 1 of the retailers' occupation tax act (35 ilcs 120/1), and sometimes marketplace facilitators, also defined in section 1 of. This chart can be used to easily calculate illinois sales taxes. Tax rate tables delivered via email monthly to keep you up to date on changing rates. This chart can be used to easily calculate california sales taxes. 51 rows generate a printable sales tax table for any city's sales tax rate to use as a quick reference for finding the tax to charge on purchases. This is a printable illinois sales tax table, by sale amount, which can be customized by sales tax rate. This is a printable california sales tax table, by sale amount, which can be customized by sales tax rate. This is a printable illinois sales tax table, by sale amount, which can be customized by sales tax rate. Effective january 1,. Find the 2025 tax rates (for money you earn in 2025). See current federal tax brackets and rates based on your income and filing status. Tax rate tables delivered via email monthly to keep you up to date on changing rates. This chart can be used to easily calculate california sales taxes. This is a printable illinois sales tax table,. This chart can be used to easily calculate california sales taxes. These rates do not include any prepared meal taxes imposed and. Tax rate tables delivered via email monthly to keep you up to date on changing rates. This is a printable california sales tax table, by sale amount, which can be customized by sales tax rate. You can print. There are a total of 514 local tax jurisdictions across the state, collecting. The 10.25% sales tax rate in chicago consists of 6.25% illinois state sales tax, 1.75% cook county sales tax, 1.25% chicago tax and 1% special tax. In illinois, occupation and use taxes are collectively referred to as “sales tax.” the retailers’ occupation tax act imposes a tax. 7% sales and use tax chart that is free to print and use. Effective january 1, 2025, certain taxing jurisdictions have imposed a local sales tax or changed their local sales tax rate on general merchandise sales. Download sales tax rate tables for any state for free. Retail sales taxes are an essential part of most states’ revenue toolkits, responsible. The 10.25% sales tax rate in chicago consists of 6.25% illinois state sales tax, 1.75% cook county sales tax, 1.25% chicago tax and 1% special tax. Illinois has state sales tax of 6.25%, and allows local governments to collect a local option sales tax of up to 4.75%. This chart can be used to easily calculate illinois sales taxes. In. 51 rows generate a printable sales tax table for any city's sales tax rate to use as a quick reference for finding the tax to charge on purchases. You can print a 10.25% sales tax. Effective january 1, 2021, remote retailers, as defined in section 1 of the retailers' occupation tax act (35 ilcs 120/1), and sometimes marketplace facilitators, also. The 10.25% sales tax rate in chicago consists of 6.25% illinois state sales tax, 1.75% cook county sales tax, 1.25% chicago tax and 1% special tax. These rates do not include any prepared meal taxes imposed and. See current federal tax brackets and rates based on your income and filing status. This chart can be used to easily calculate illinois. Listed below by county are the total (4.75% state rate plus applicable local and transit rates) sales and use tax rates.note: 7% sales and use tax chart that is free to print and use. Effective january 1, 2021, remote retailers, as defined in section 1 of the retailers' occupation tax act (35 ilcs 120/1), and sometimes marketplace facilitators, also defined. This chart can be used to easily calculate illinois sales taxes. Find the 2025 tax rates (for money you earn in 2025). This chart can be used to easily calculate california sales taxes. The following taxes are affected:. 7% sales and use tax chart that is free to print and use. These rates do not include any prepared meal taxes imposed and. Retail sales taxes are an essential part of most states’ revenue toolkits, responsible for 32 percent of state taxa tax is a mandatory payment or charge collected by local, state,. This is a printable illinois sales tax table, by sale amount, which can be customized by sales tax rate. Download sales tax rate tables for any state for free. Tax rate tables delivered via email monthly to keep you up to date on changing rates. 7% sales and use tax chart that is free to print and use. These charts can serve as handy references in your day to day sales and use tax work. This chart can be used to easily calculate illinois sales taxes. This chart can be used to easily calculate illinois sales taxes. Bookmark this page or print off a chart to have quick access to state sales tax rates, sales tax holiday. This is a printable california sales tax table, by sale amount, which can be customized by sales tax rate. In illinois, occupation and use taxes are collectively referred to as “sales tax.” the retailers’ occupation tax act imposes a tax upon persons engaged in this state in the business of. See current federal tax brackets and rates based on your income and filing status. This chart can be used to easily calculate 9% sales taxes. This chart can be used to easily calculate california sales taxes. The following taxes are affected:.Where to Find and How to Read 1040 Tax Tables

Printable Sales Tax Chart

Printable Sales Tax Chart

How to Calculate Sales Tax in Excel Tutorial YouTube

Printable Sales Tax Chart A Visual Reference of Charts Chart Master

State Of Washington 7.5 Retail Sales Tax Collection Shcedule printable

Sales taxes in the United States Wikipedia

7 25 Sales Tax Chart Printable Printable Word Searches

Printable Sales Tax Chart

Printable Sales Tax Chart

There Are A Total Of 514 Local Tax Jurisdictions Across The State, Collecting.

This Is A Printable 9% Sales Tax Table, By Sale Amount, Which Can Be Customized By Sales Tax Rate.

Effective January 1, 2021, Remote Retailers, As Defined In Section 1 Of The Retailers' Occupation Tax Act (35 Ilcs 120/1), And Sometimes Marketplace Facilitators, Also Defined In Section 1 Of.

Listed Below By County Are The Total (4.75% State Rate Plus Applicable Local And Transit Rates) Sales And Use Tax Rates.note:

Related Post:

:max_bytes(150000):strip_icc()/2020IRSTaxTablesScreenShot-16679838387b47b492ac296463926902.jpg)