Printable Credit Card Authorization Form

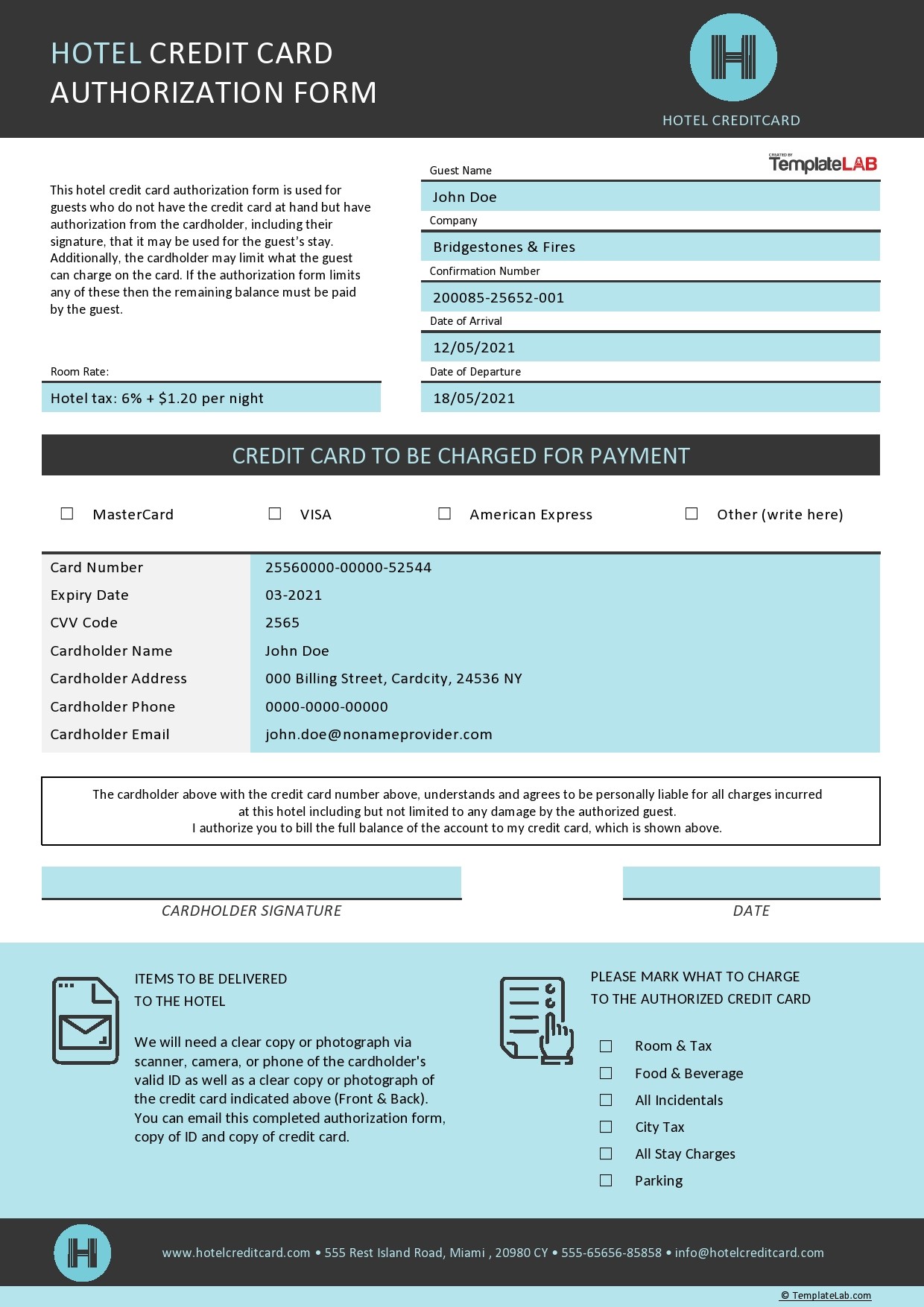

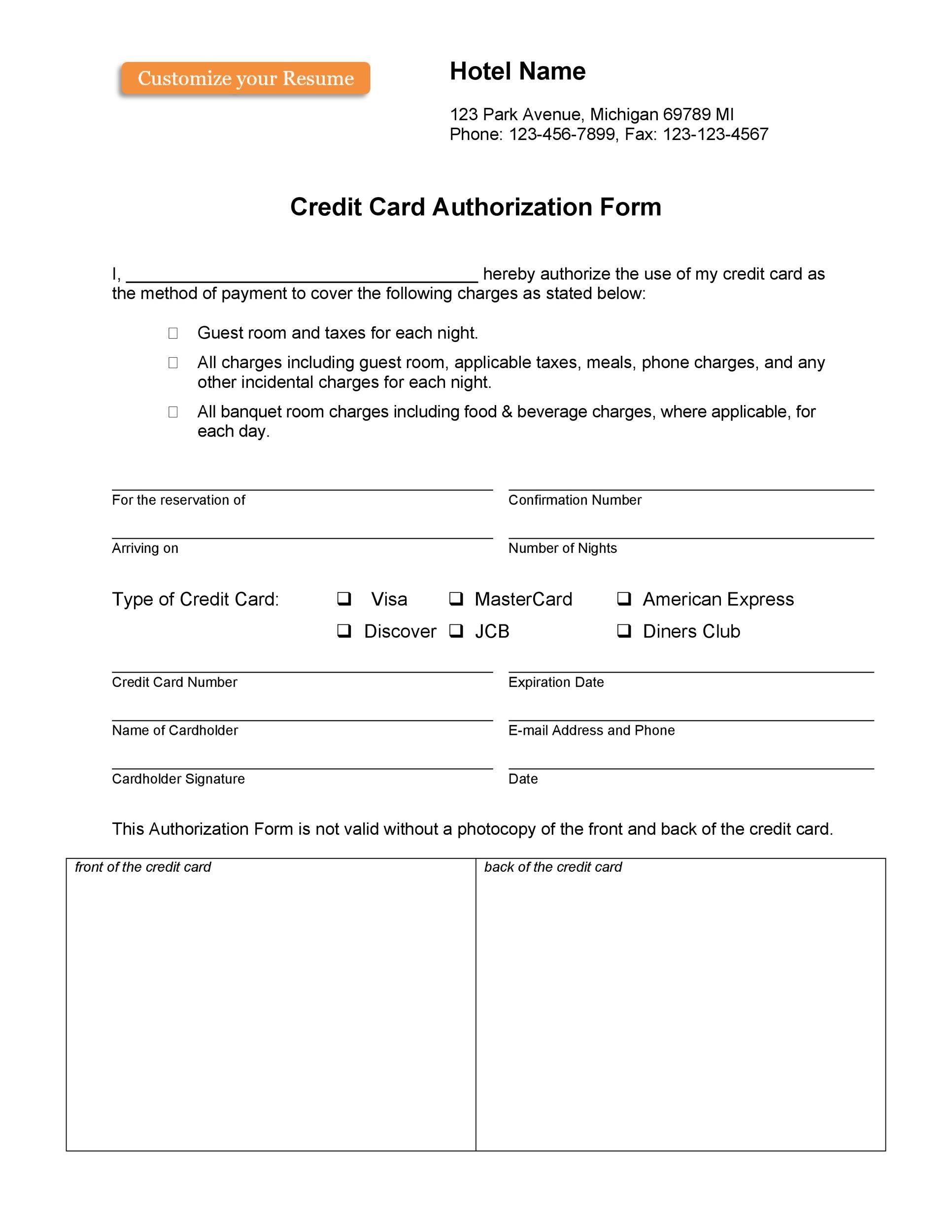

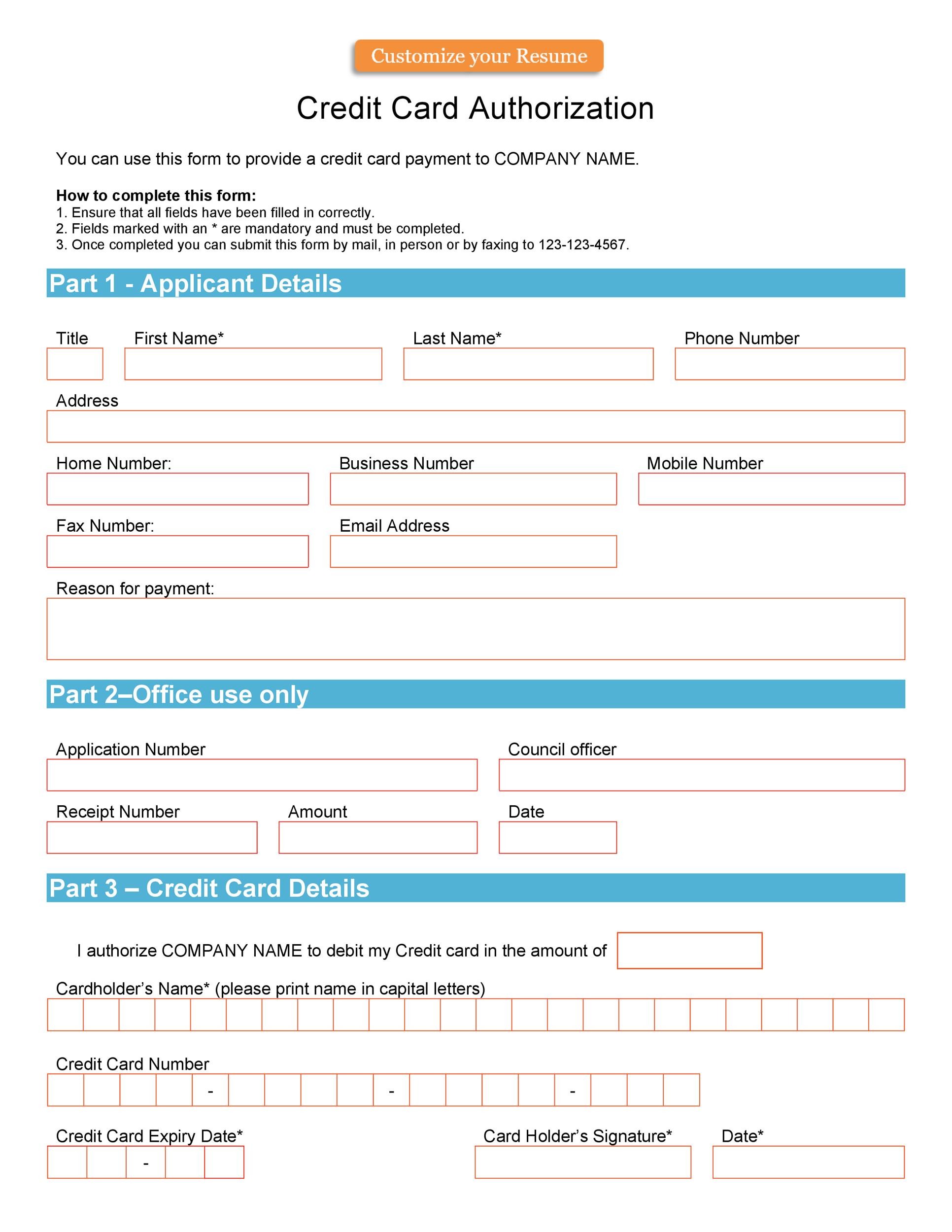

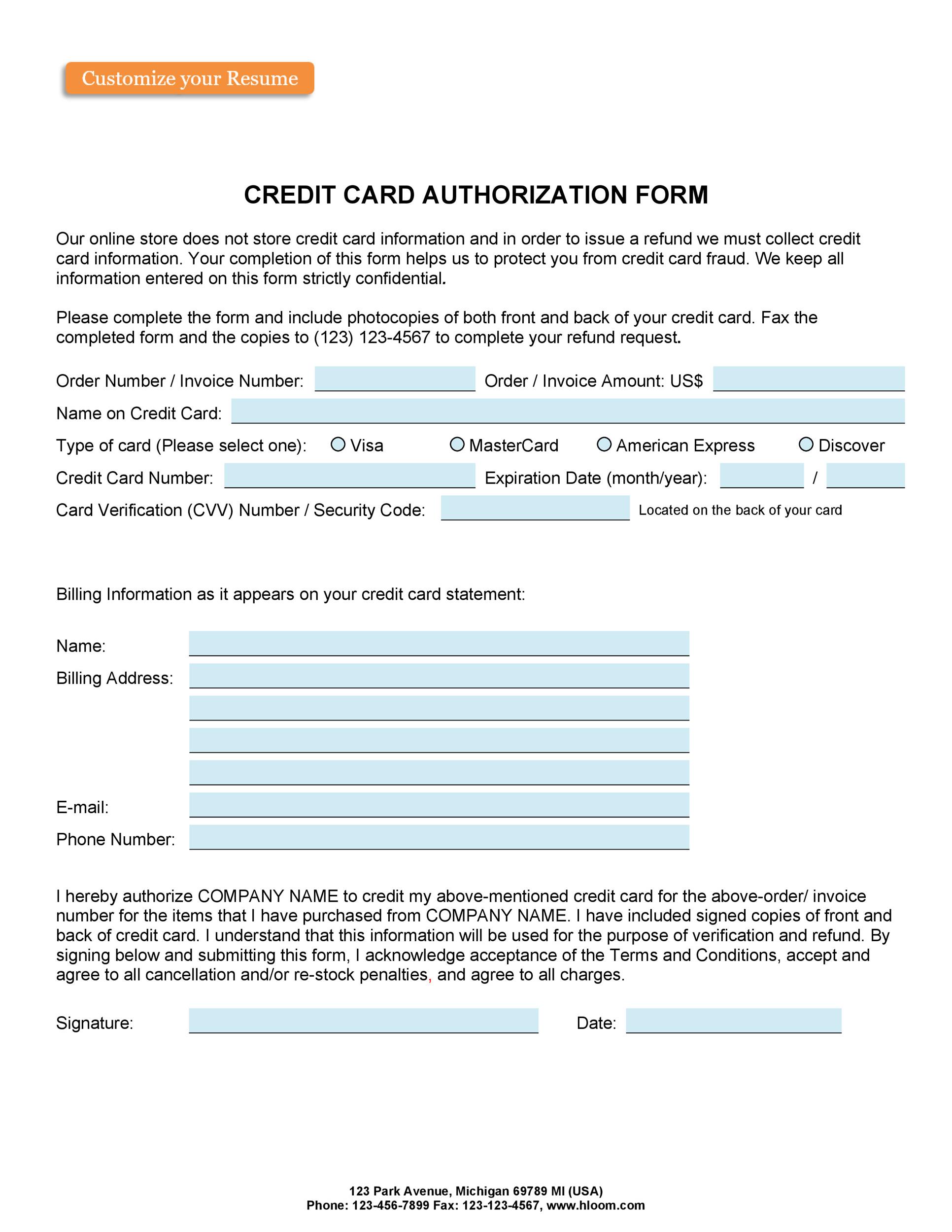

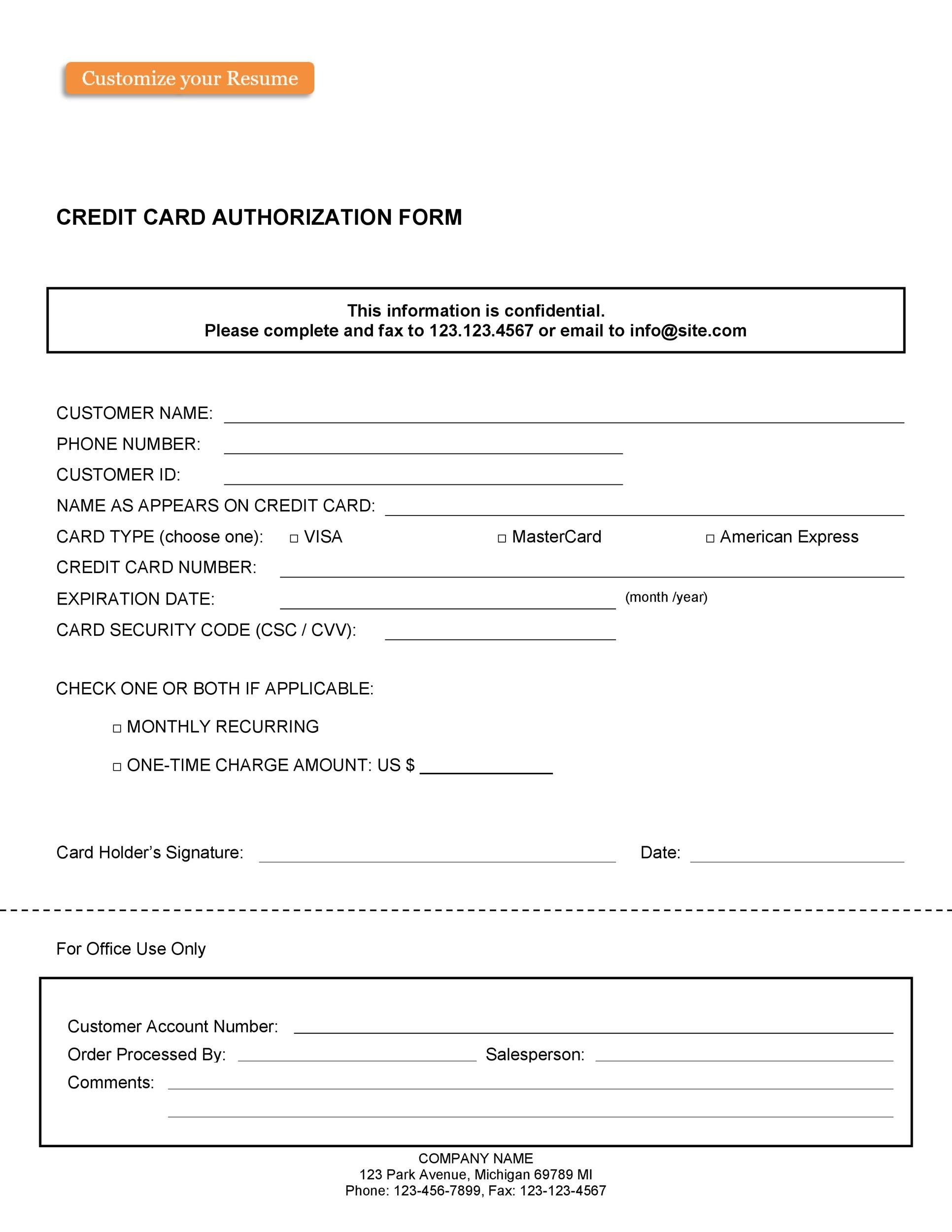

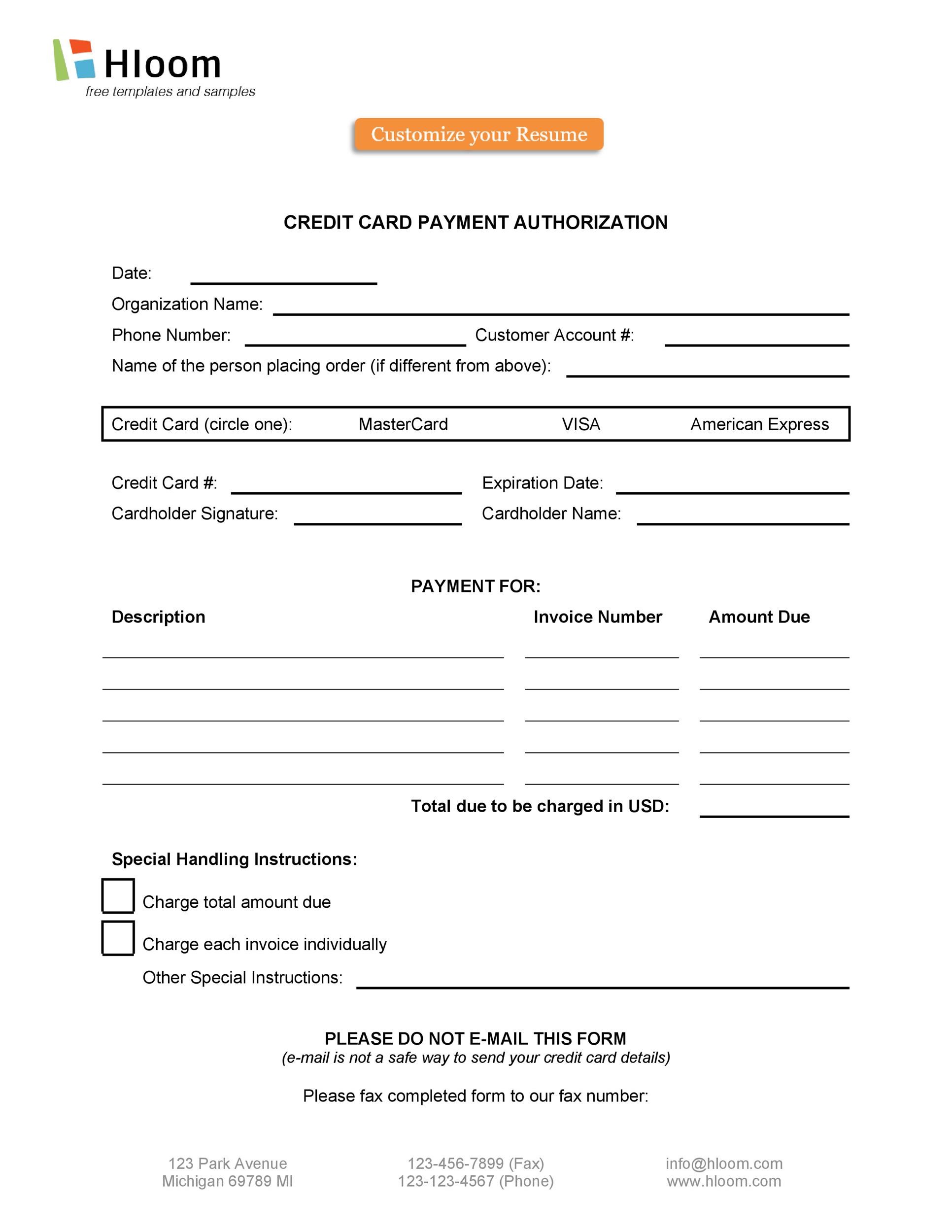

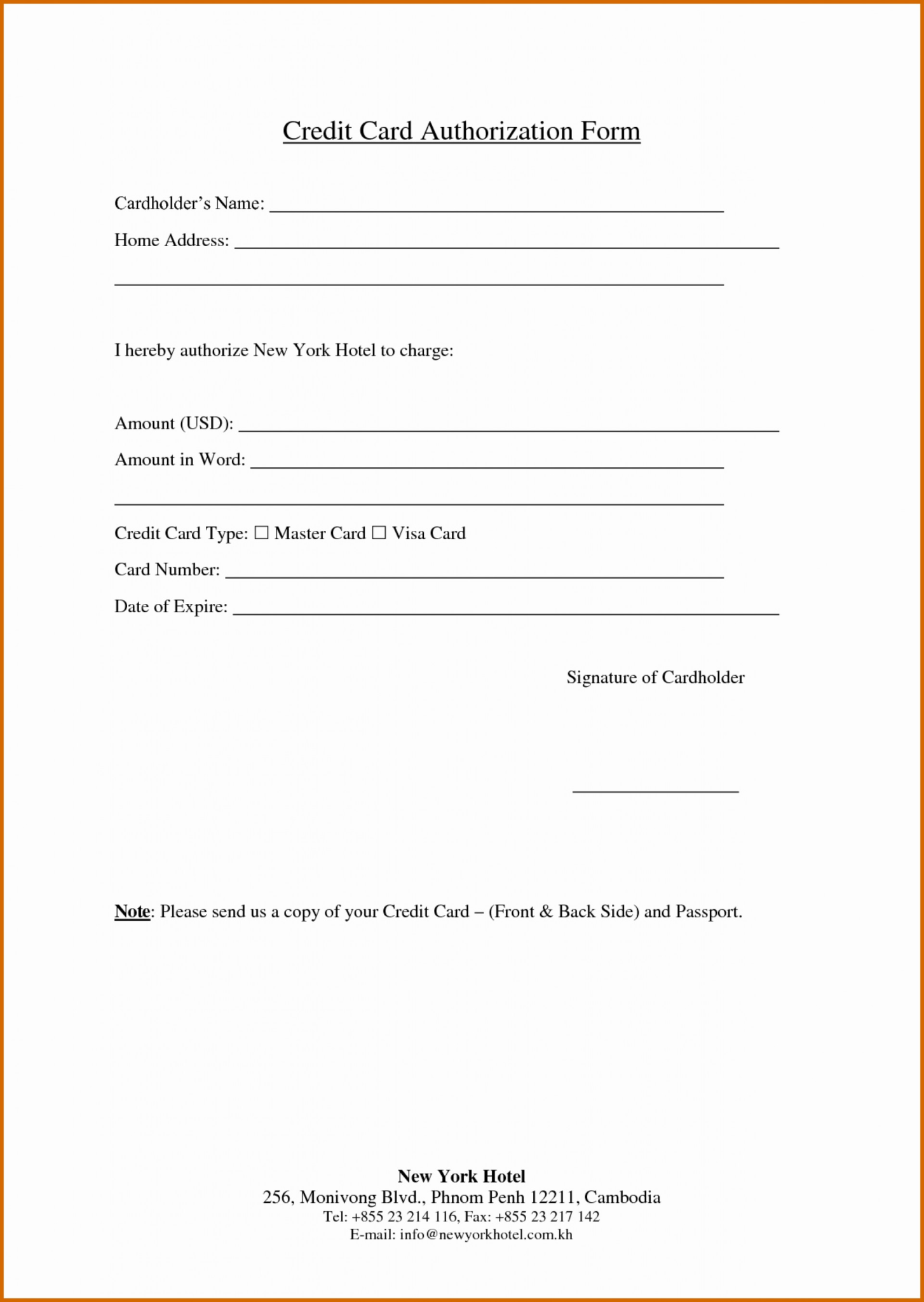

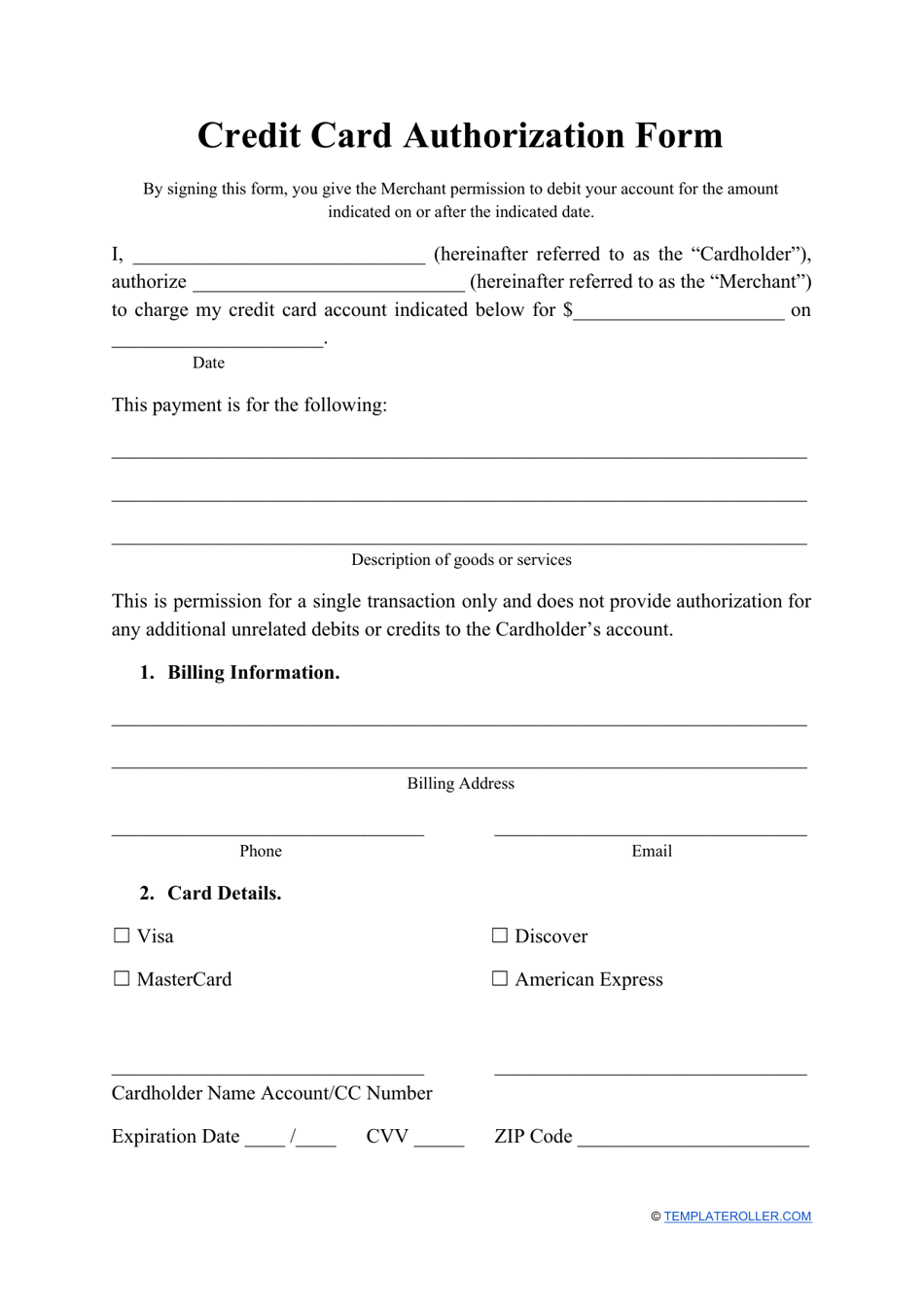

Printable Credit Card Authorization Form - Download a printable pdf form to authorize a merchant to charge your credit card for purchases. An authorized user on a credit card can make purchases on a primary cardholder’s account to help build credit and practice using the card responsibly. Learn how to accept a payment and prevent. This protects me from situations where a client. Learn how to use and fill out credit card authorization forms and what. Download a credit card and ach authorization forms which allows a third (3rd) party in the name of a business or individual to charge another person’s credit card or bank account. You authorize a single (1) or regularly scheduled charge to your credit card or bank account. It’s especially useful for recurring. You do not have to process payments with square to use these templates. In this article, you will learn what a credit card authorization form is, how to fill it in, and where to get and download a template for free. It’s especially useful for recurring. Learn how to accept a payment and prevent. Sections for the credit cardholder's information along with the authorized user are. You will be charged the amount indicated below each billing period. A receipt for each payment will. Square offers two free generic credit card authorization forms for download. Credit card authorization forms are a way for companies to process payments securely. Print and have a credit cardholder complete this single page form to authorize charges on their account. These printable form provides a record of the cardholder’s consent to the transaction, ensuring that the merchant can securely process the charge. An authorized user on a credit card can make purchases on a primary cardholder’s account to help build credit and practice using the card responsibly. A receipt for each payment will. Download a printable pdf form to authorize a merchant to charge your credit card for purchases. A credit card authorization form is a document signed by the cardholder giving me permission to charge their card for services. You will be charged the amount indicated below each billing period. This protects me from situations where. Square offers two free generic credit card authorization forms for download. A receipt for each payment will. The form allows customers to authorize businesses or organizations to take specific. These printable form provides a record of the cardholder’s consent to the transaction, ensuring that the merchant can securely process the charge. A credit card authorization form is a document signed. You authorize a single (1) or regularly scheduled charge to your credit card or bank account. Download a credit card and ach authorization forms which allows a third (3rd) party in the name of a business or individual to charge another person’s credit card or bank account. Learn how to use and fill out credit card authorization forms and what.. You will be charged the amount indicated below each billing period. Learn how to use and fill out credit card authorization forms and what. By signing this form, you. Fill in the card details, consent, and signature, and date the form. This protects me from situations where a client. Download a printable pdf form to authorize a merchant to charge your credit card for purchases. Print and have a credit cardholder complete this single page form to authorize charges on their account. You will be charged the amount indicated below each billing period. These printable form provides a record of the cardholder’s consent to the transaction, ensuring that the. Download a credit card and ach authorization forms which allows a third (3rd) party in the name of a business or individual to charge another person’s credit card or bank account. Fill in the card details, consent, and signature, and date the form. Square offers two free generic credit card authorization forms for download. These printable form provides a record. A credit card authorization form is a document signed by the cardholder giving me permission to charge their card for services. It’s especially useful for recurring. You do not have to process payments with square to use these templates. In this article, you will learn what a credit card authorization form is, how to fill it in, and where to. Learn how to use and fill out credit card authorization forms and what. Learn how to accept a payment and prevent. Sections for the credit cardholder's information along with the authorized user are. These printable form provides a record of the cardholder’s consent to the transaction, ensuring that the merchant can securely process the charge. You do not have to. You will be charged the amount indicated below each billing period. You do not have to process payments with square to use these templates. In this article, you will learn what a credit card authorization form is, how to fill it in, and where to get and download a template for free. Learn how to accept a payment and prevent.. This protects me from situations where a client. Fill in the card details, consent, and signature, and date the form. These printable form provides a record of the cardholder’s consent to the transaction, ensuring that the merchant can securely process the charge. An authorized user on a credit card can make purchases on a primary cardholder’s account to help build. By signing this form, you. In this article, you will learn what a credit card authorization form is, how to fill it in, and where to get and download a template for free. Print and have a credit cardholder complete this single page form to authorize charges on their account. A credit card authorization form is a document signed by the cardholder giving me permission to charge their card for services. The form allows customers to authorize businesses or organizations to take specific. You will be charged the amount indicated below each billing period. A receipt for each payment will. An authorized user on a credit card can make purchases on a primary cardholder’s account to help build credit and practice using the card responsibly. Learn how to use and fill out credit card authorization forms and what. Credit card authorization forms are a way for companies to process payments securely. I, _____, authorize_____ to charge the credit card detailed above for agreed upon payments of $____________ on a recurring basis on the _________(day) of each week/month. It’s especially useful for recurring. Sections for the credit cardholder's information along with the authorized user are. Fill in the card details, consent, and signature, and date the form. Download a credit card and ach authorization forms which allows a third (3rd) party in the name of a business or individual to charge another person’s credit card or bank account. This protects me from situations where a client.free 41 credit card authorization forms templates {readytouse} credit

43 Credit Card Authorization Forms Templates {ReadytoUse}

41 Credit Card Authorization Forms Templates {ReadytoUse}

41 Credit Card Authorization Forms Templates {ReadytoUse}

43 Credit Card Authorization Forms Templates {ReadytoUse}

41 Credit Card Authorization Forms Templates {ReadytoUse}

43 Credit Card Authorization Forms Templates {ReadytoUse}

Credit Card Authorization Form Template Word Business.fromgrandma.best

Credit Card Authorization Form Fill Out, Sign Online and Download PDF

43 Credit Card Authorization Forms Templates {ReadytoUse}

Learn How To Accept A Payment And Prevent.

You Do Not Have To Process Payments With Square To Use These Templates.

Square Offers Two Free Generic Credit Card Authorization Forms For Download.

You Authorize A Single (1) Or Regularly Scheduled Charge To Your Credit Card Or Bank Account.

Related Post: