Printable 19 Form

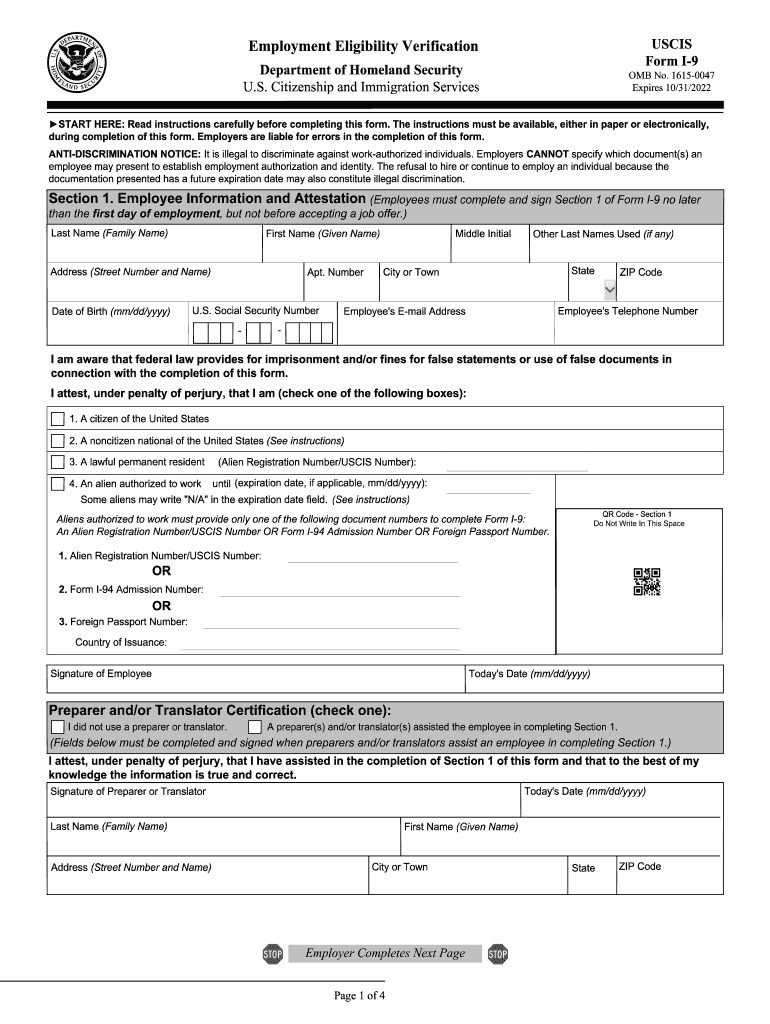

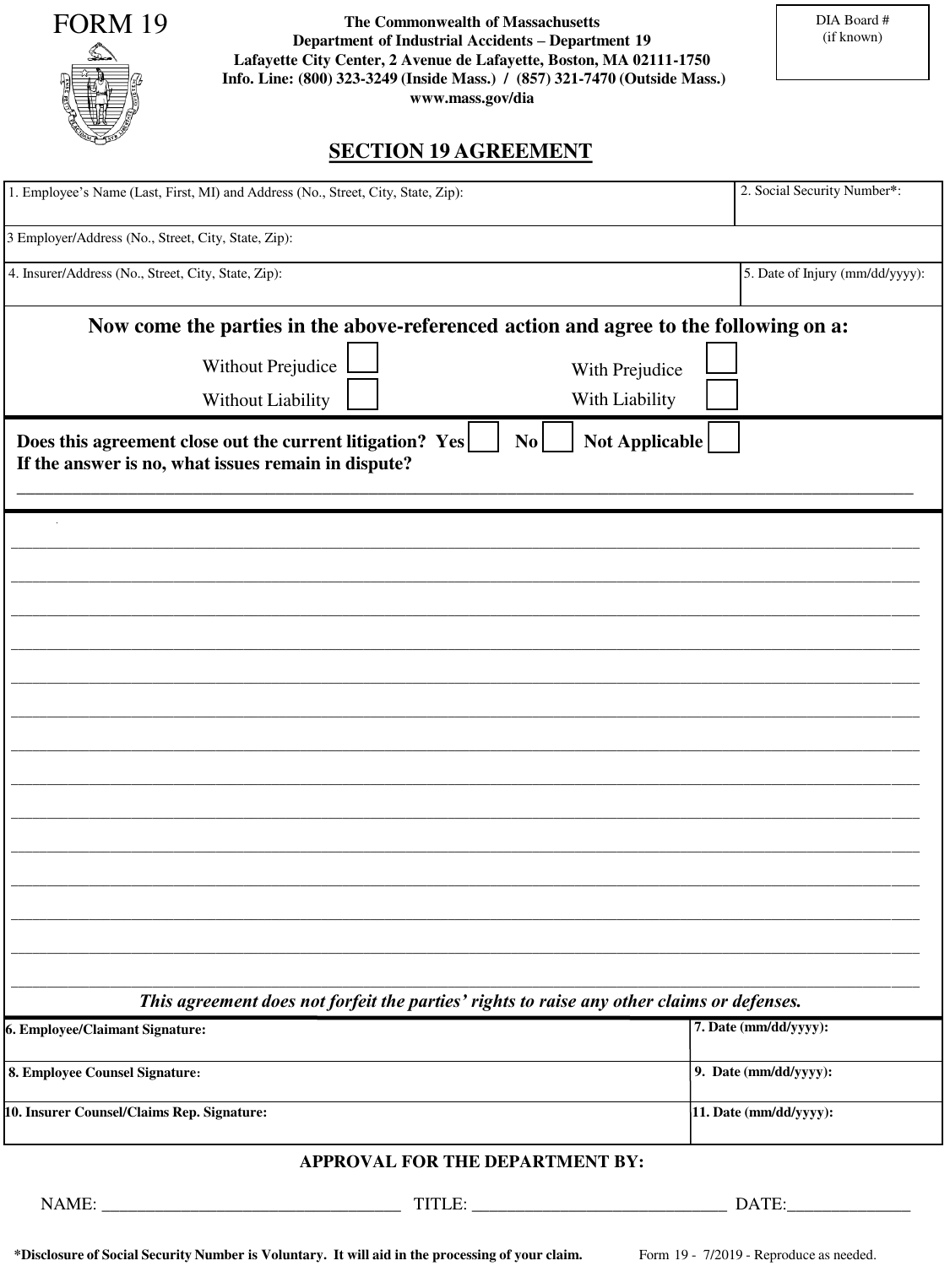

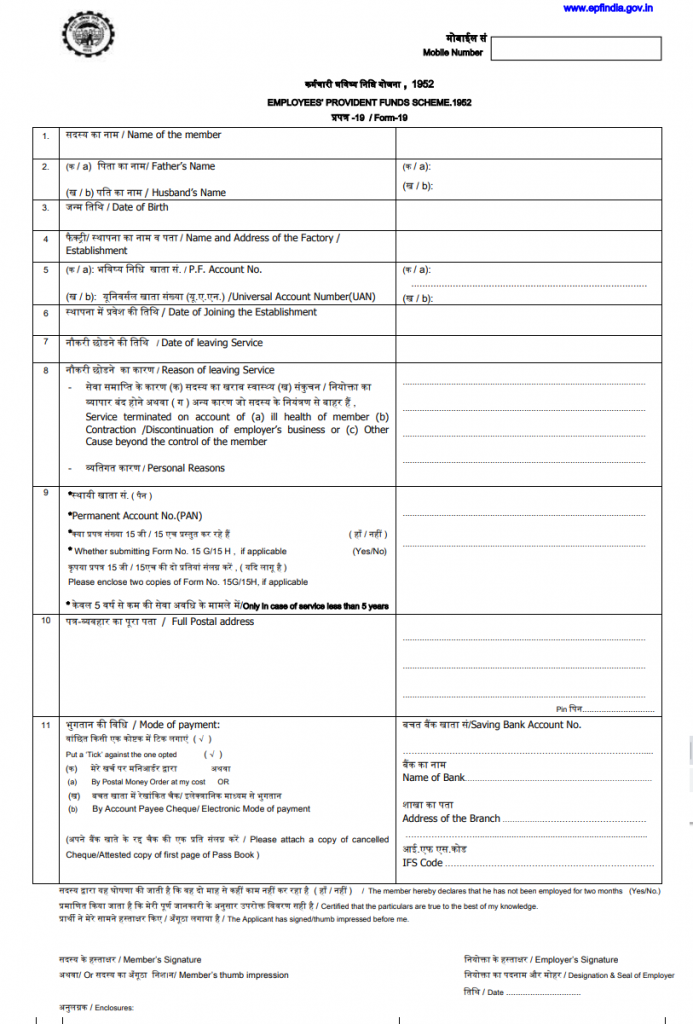

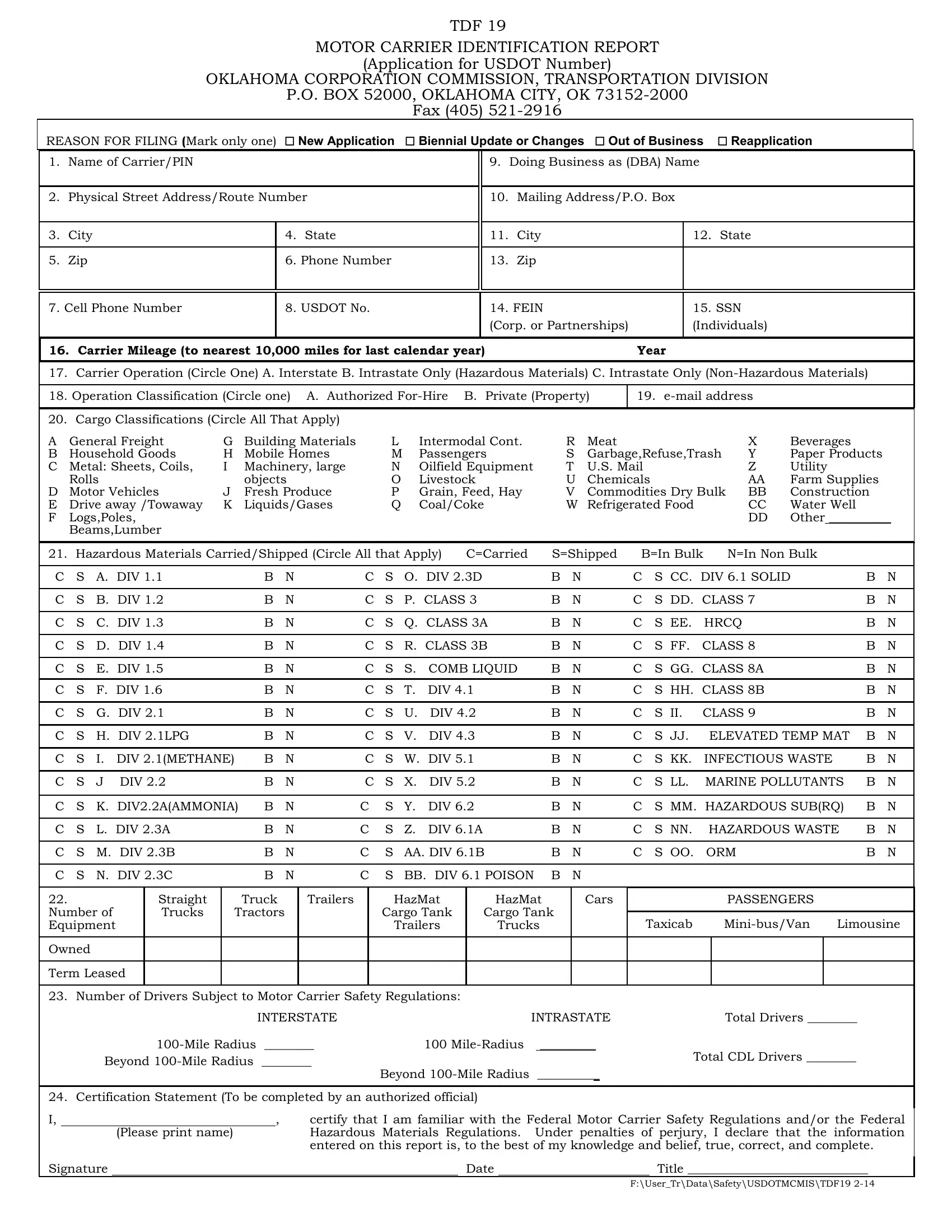

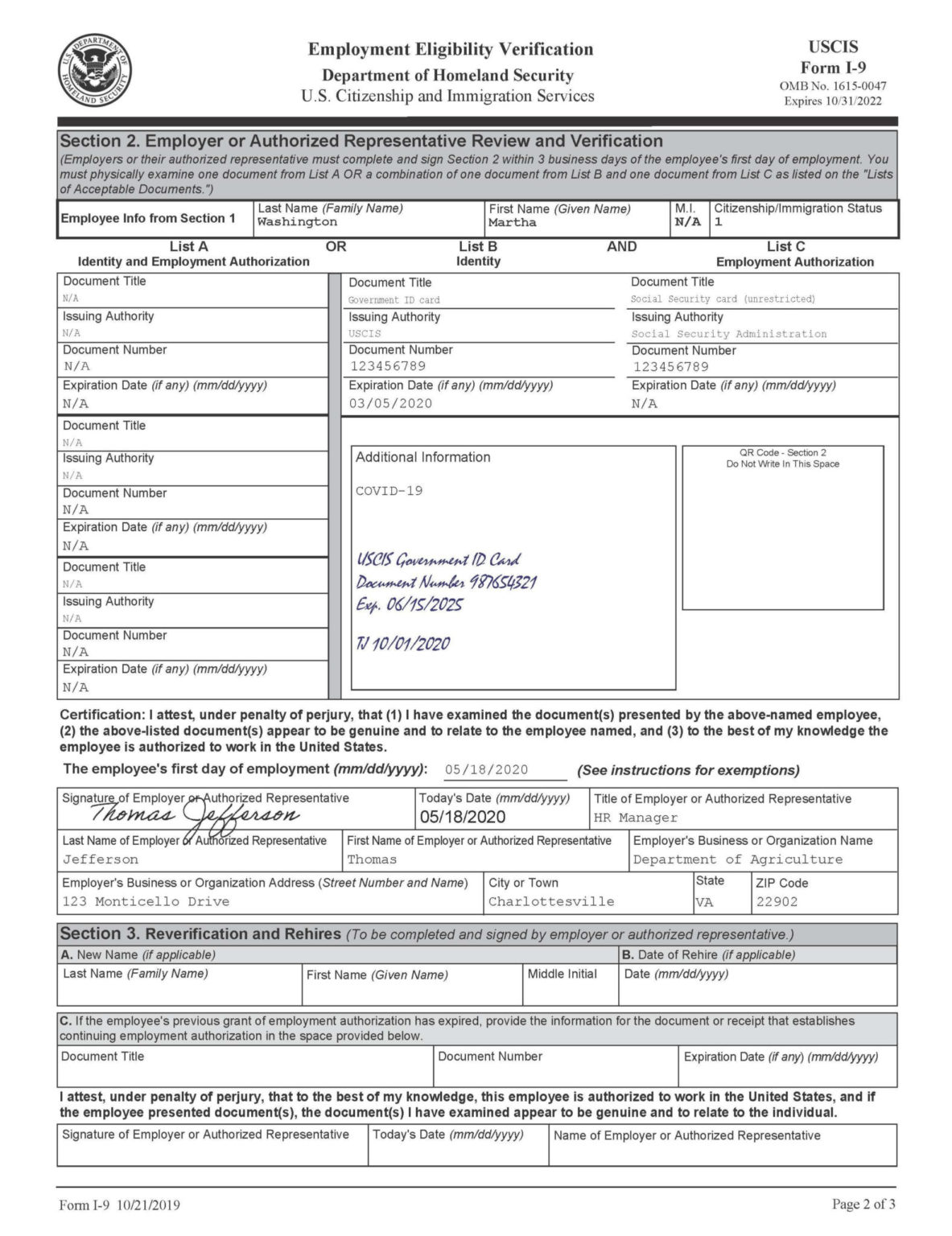

Printable 19 Form - Read instructions carefully before completing this form. A copy may also be filed in the employee’s official personnel folder. As part of the proposition 19 implementation process, state board of equalization (the boe), in consultation with the california assessors' association, has created the following. (applicable in cases where employee's complete details in form i i (new), aadhaar number and bank accounts details are available on uan portal and uan has been activated) 2. This form is in portable document format (.pdf) that is fillable and. The instructions must be available during. Citizenship and immigration services, will help you verify your employee's identity and employment authorization. Give form to the requester. The instructions must be available, either in paper or electronically, during completion of this form. 5695 (2024) form 5695 (2024) page. 5695 (2024) form 5695 (2024) page. The instructions must be available, either in paper or electronically, during completion of this form. We’ll help you understand what it is, when you need to file it, and how to fill it out. 2 part ii energy efficient home improvement credit section a—qualified energy efficiency improvements. As part of the proposition 19 implementation process, state board of equalization (the boe), in consultation with the california assessors' association, has created the following. Only use this page if your employee requires reverification, is rehired within three years of the date the. Do not send to the irs. The form is used to document verification of the identity and employment authorization of each new employee. Form 19 must be transmitted to the commission through your insurance carrier/claims administrator, and is required by law to be filed within 5 days after knowledge of accident. The instructions must be available during. The instructions must be available, either in paper or electronically, during completion of this form. The form is used to document verification of the identity and employment authorization of each new employee. 5695 (2024) form 5695 (2024) page. A copy may also be filed in the employee’s official personnel folder. As part of the proposition 19 implementation process, state board. Form 19 must be transmitted to the commission through your insurance carrier/claims administrator, and is required by law to be filed within 5 days after knowledge of accident. Go to www.irs.gov/formw9 for instructions and the latest information. As part of the proposition 19 implementation process, state board of equalization (the boe), in consultation with the california assessors' association, has created. Only use this page if your employee requires reverification, is rehired within three years of the date the. Access irs forms, instructions and publications in electronic and print media. (applicable in cases where employee's complete details in form i i (new), aadhaar number and bank accounts details are available on uan portal and uan has been activated) 2. 2 part. Citizenship and immigration services, will help you verify your employee's identity and employment authorization. Give form to the requester. (applicable in cases where employee's complete details in form i i (new), aadhaar number and bank accounts details are available on uan portal and uan has been activated) 2. The gaining agency should provide a copy of the completed form to. Do not send to the irs. Only use this page if your employee requires reverification, is rehired within three years of the date the. A copy may also be filed in the employee’s official personnel folder. The instructions must be available during. 5695 (2024) form 5695 (2024) page. The gaining agency should provide a copy of the completed form to the employee and forward the original to the payroll office. 2 part ii energy efficient home improvement credit section a—qualified energy efficiency improvements. Do not send to the irs. This form is in portable document format (.pdf) that is fillable and. A copy may also be filed in. We’ll help you understand what it is, when you need to file it, and how to fill it out. A copy may also be filed in the employee’s official personnel folder. 2 part ii energy efficient home improvement credit section a—qualified energy efficiency improvements. As part of the proposition 19 implementation process, state board of equalization (the boe), in consultation. 5695 (2024) form 5695 (2024) page. The instructions must be available during. The form is used to document verification of the identity and employment authorization of each new employee. (applicable in cases where employee's complete details in form i i (new), aadhaar number and bank accounts details are available on uan portal and uan has been activated) 2. This form. The form is used to document verification of the identity and employment authorization of each new employee. The instructions must be available during. As part of the proposition 19 implementation process, state board of equalization (the boe), in consultation with the california assessors' association, has created the following. 5695 (2024) form 5695 (2024) page. Do not send to the irs. (applicable in cases where employee's complete details in form i i (new), aadhaar number and bank accounts details are available on uan portal and uan has been activated) 2. 2 part ii energy efficient home improvement credit section a—qualified energy efficiency improvements. Form 19 must be transmitted to the commission through your insurance carrier/claims administrator, and is required by law. We’ll help you understand what it is, when you need to file it, and how to fill it out. Only use this page if your employee requires reverification, is rehired within three years of the date the. Citizenship and immigration services, will help you verify your employee's identity and employment authorization. Do not send to the irs. 2 part ii energy efficient home improvement credit section a—qualified energy efficiency improvements. A copy may also be filed in the employee’s official personnel folder. 5695 (2024) form 5695 (2024) page. Form 19 must be transmitted to the commission through your insurance carrier/claims administrator, and is required by law to be filed within 5 days after knowledge of accident. Give form to the requester. Access irs forms, instructions and publications in electronic and print media. The instructions must be available during. This form is in portable document format (.pdf) that is fillable and. As part of the proposition 19 implementation process, state board of equalization (the boe), in consultation with the california assessors' association, has created the following. (applicable in cases where employee's complete details in form i i (new), aadhaar number and bank accounts details are available on uan portal and uan has been activated) 2. Expires 08/31/12 read instructions carefully before completing this form. The form is used to document verification of the identity and employment authorization of each new employee.2019 Form USCIS I9Fill Online, Printable, Fillable, Blank pdfFiller

Fillable Online www.uscis.govi9centralcovid19formi9COVID19

19 Fillable Form Printable Forms Free Online

Ui19 Printable Form Printable Forms Free Online

Printable Form 19 Printable Forms Free Online

Tdf 19 Form ≡ Fill Out Printable PDF Forms Online

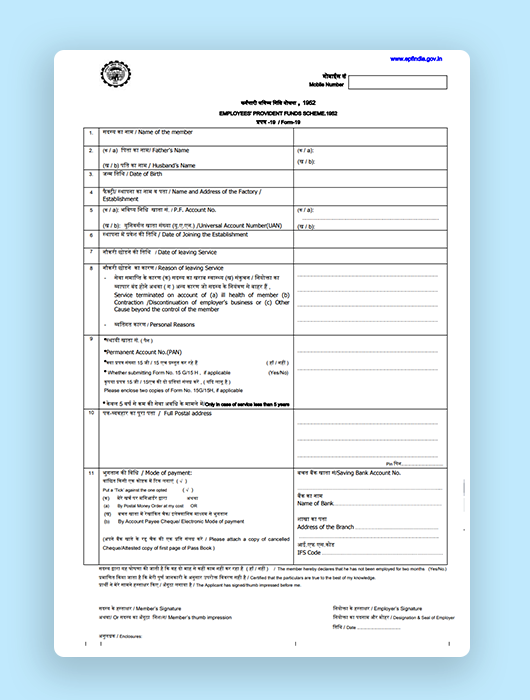

EPF Form 19 Steps to Fill Form 19 for PF Withdrawal in 2024

I9 Acceptable forms of Identification by UW Madison Housing Issuu

Form I 9 Examples Related To Temporary Covid 19 Policies i9 Form 2021

Printable I 9 Form Print 2019

Go To Www.irs.gov/Formw9 For Instructions And The Latest Information.

Read Instructions Carefully Before Completing This Form.

The Gaining Agency Should Provide A Copy Of The Completed Form To The Employee And Forward The Original To The Payroll Office.

The Instructions Must Be Available, Either In Paper Or Electronically, During Completion Of This Form.

Related Post: