Printable 1099 Forms For Independent Contractors

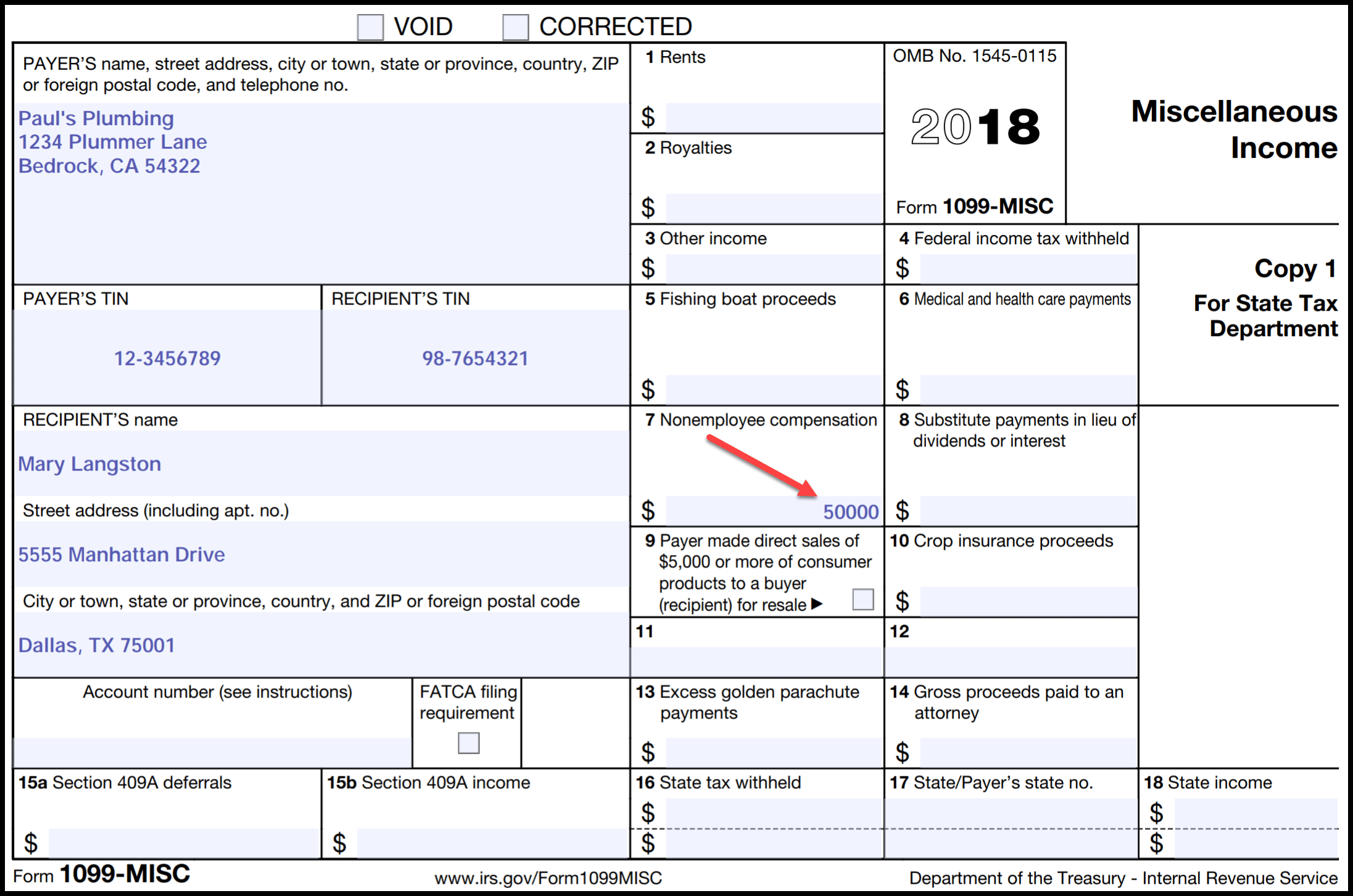

Printable 1099 Forms For Independent Contractors - One copy goes to you and another copy goes to the irs. Independent contractors are among the recipients who should receive a 1099 form. Generally, the person for whom the services are performed must report payments to. Ensure that you have their taxpayer identification number (tin) and business. What is a 1099 form and who needs to file it? How to fill out form 1099 for independent contractor? What is a 1099 contractor? This form can be used to request the correct name and taxpayer identification number, or tin, of. A 1099 form is a tax form used by independent contractors or freelancers to report income other than wages, salary, and tips. Seller’s investment in life insurance contract. How to fill out form 1099 for independent contractor? You must also complete form 8919 and attach it to your return. What is a 1099 form and who needs to file it? What is a 1099 contractor? A 1099 employee, more accurately known as an independent contractor, is a worker who provides services to a company but is not classified as an employee. The following forms are available: Business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system.the iris. Ensure that you have their taxpayer identification number (tin) and business. Understanding the intricacies of 1099 forms, their purpose, different types, and the correct procedures for filing is essential for both independent contractors and the businesses hiring them. A 1099 contractor, often referred to as an independent contractor,. Ensure that you have their taxpayer identification number (tin) and business. Many, or all, of the. A 1099 form is a record that an entity or person (not your employer) gave or paid you money. The following forms are available: A 1099 contractor, often referred to as an independent contractor,. Generally, the person for whom the services are performed must report payments to. What is a 1099 form and who needs to file it? A 1099 employee, more accurately known as an independent contractor, is a worker who provides services to a company but is not classified as an employee. This page allows state of illinois vendors to view and. To fill out the 1099 form, start by gathering all necessary information from your independent contractors. One copy goes to you and another copy goes to the irs. A 1099 contractor, often referred to as an independent contractor,. Go to www.irs.gov/freefile to see if you. How to fill out form 1099 for independent contractor? This page allows state of illinois vendors to view and print copies of 1099 forms issued by the state of illinois comptroller's office. There are nearly two dozen different kinds of 1099 forms, and each. Independent contractors are among the recipients who should receive a 1099 form. Ensure that you have their taxpayer identification number (tin) and business. If your. Generally, the person for whom the services are performed must report payments to. A 1099 contractor, often referred to as an independent contractor,. Seller’s investment in life insurance contract. Business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system.the iris. The distinction between independent contractors and traditional employees is significant. A 1099 form is a record that an entity or person (not your employer) gave or paid you money. This form can be used to request the correct name and taxpayer identification number, or tin, of. If your organization paid over $600 for services this year or withheld. There are nearly two dozen different kinds of 1099 forms, and each.. The following forms are available: Understanding the intricacies of 1099 forms, their purpose, different types, and the correct procedures for filing is essential for both independent contractors and the businesses hiring them. Business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system.the iris. This page allows state of illinois vendors. One copy goes to you and another copy goes to the irs. This form can be used to request the correct name and taxpayer identification number, or tin, of. Go to www.irs.gov/freefile to see if you. Once 1099 forms are prepared according to irs standards, businesses must distribute them to recipients, such as independent contractors or service providers, who use.. Ensure that you have their taxpayer identification number (tin) and business. A 1099 form is a record that an entity or person (not your employer) gave or paid you money. Business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system.the iris. Our guide describes the basics of the nearly two. What is a 1099 form and who needs to file it? A 1099 form is a record that an entity or person (not your employer) gave or paid you money. Go to www.irs.gov/freefile to see if you. Independent contractors are among the recipients who should receive a 1099 form. How to fill out form 1099 for independent contractor? Our guide describes the basics of the nearly two dozen different 1099 forms used to report income to the irs. How to fill out form 1099 for independent contractor? To fill out the 1099 form, start by gathering all necessary information from your independent contractors. Once 1099 forms are prepared according to irs standards, businesses must distribute them to recipients, such as independent contractors or service providers, who use. Many, or all, of the. A 1099 contractor, often referred to as an independent contractor,. If your organization paid over $600 for services this year or withheld. The distinction between independent contractors and traditional employees is significant in employment law, influencing 1099 verification letters. Business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system.the iris. The following forms are available: Seller’s investment in life insurance contract. This form can be used to request the correct name and taxpayer identification number, or tin, of. Understanding the intricacies of 1099 forms, their purpose, different types, and the correct procedures for filing is essential for both independent contractors and the businesses hiring them. One copy goes to you and another copy goes to the irs. Ensure that you have their taxpayer identification number (tin) and business. You must also complete form 8919 and attach it to your return.Printable 1099 Form Independent Contractor Form Resume Examples

Printable 1099 Forms For Independent Contractors

1099 form independent contractor Fill online, Printable, Fillable Blank

Printable 1099 Form Independent Contractor Printable Form, Templates

Printable 1099 Forms For Independent Contractors

1099 Printable Forms

IRS Form 1099 Reporting for Small Business Owners

Printable Independent Contractor 1099 Form Printable Forms Free Online

Printable 1099 Form Independent Contractor

Free Independent Contractor Agreement Template 1099 Word PDF eForms

What Is A 1099 Form And Who Needs To File It?

A 1099 Form Is A Record That An Entity Or Person (Not Your Employer) Gave Or Paid You Money.

Independent Contractors Are Among The Recipients Who Should Receive A 1099 Form.

A 1099 Form Is A Tax Form Used By Independent Contractors Or Freelancers To Report Income Other Than Wages, Salary, And Tips.

Related Post: