940 Printable Form

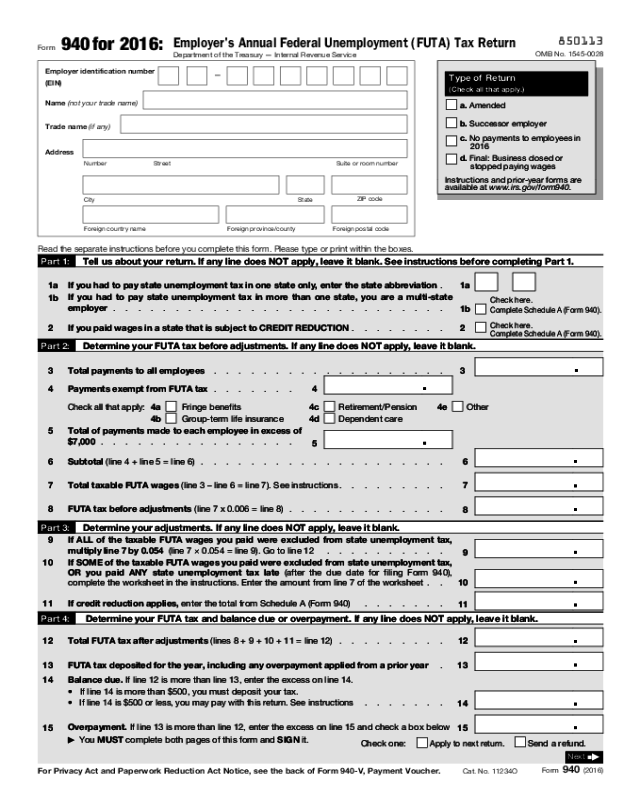

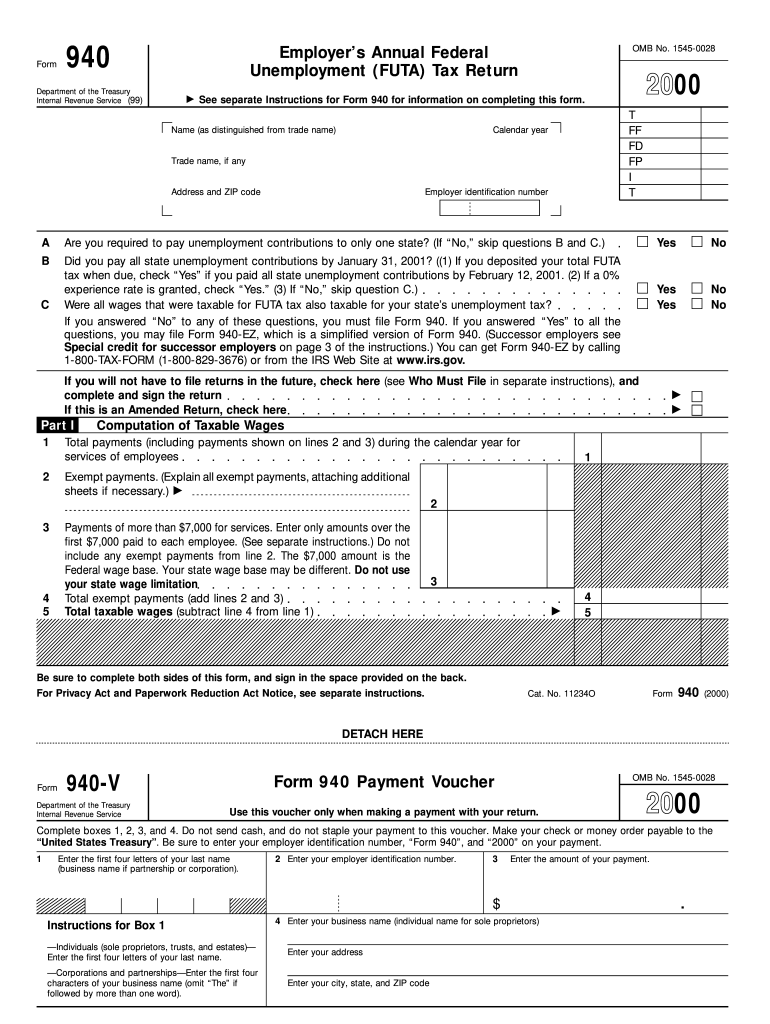

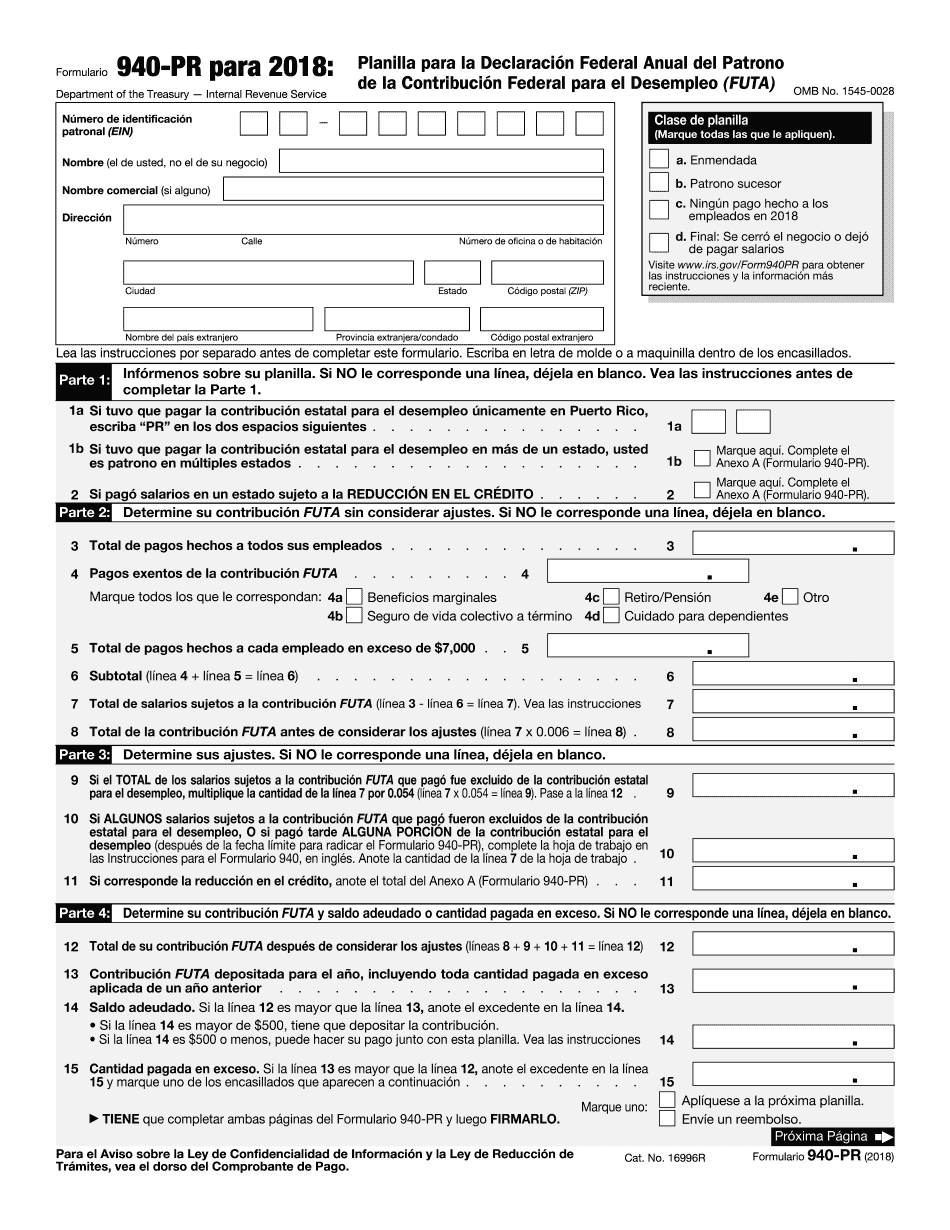

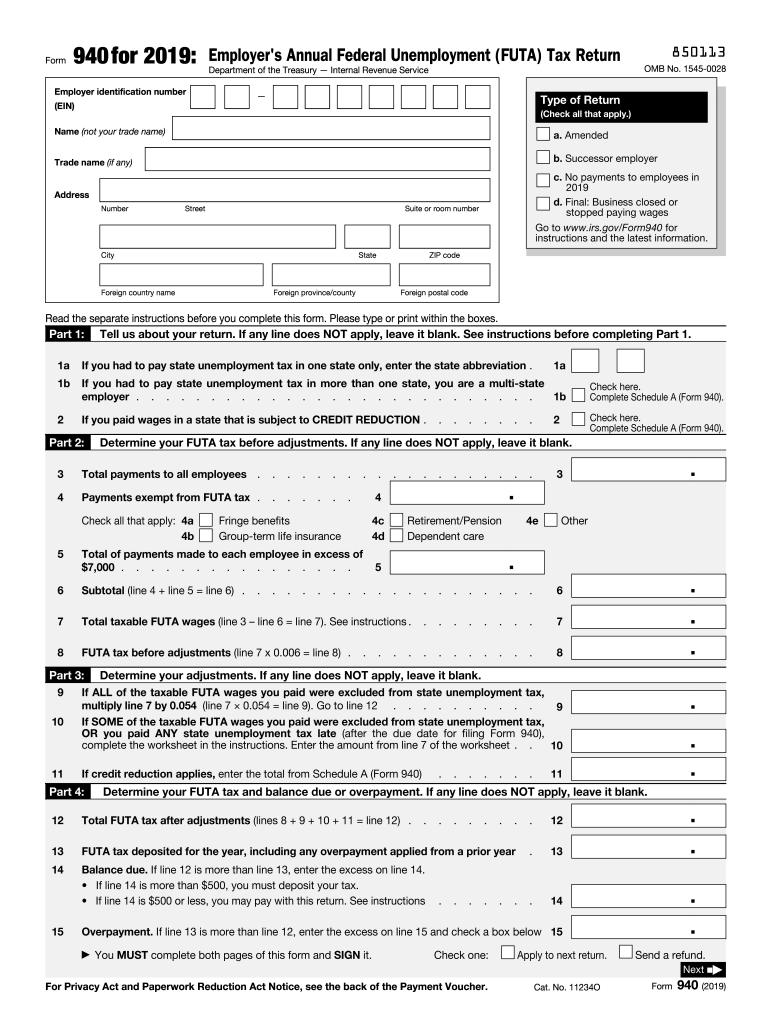

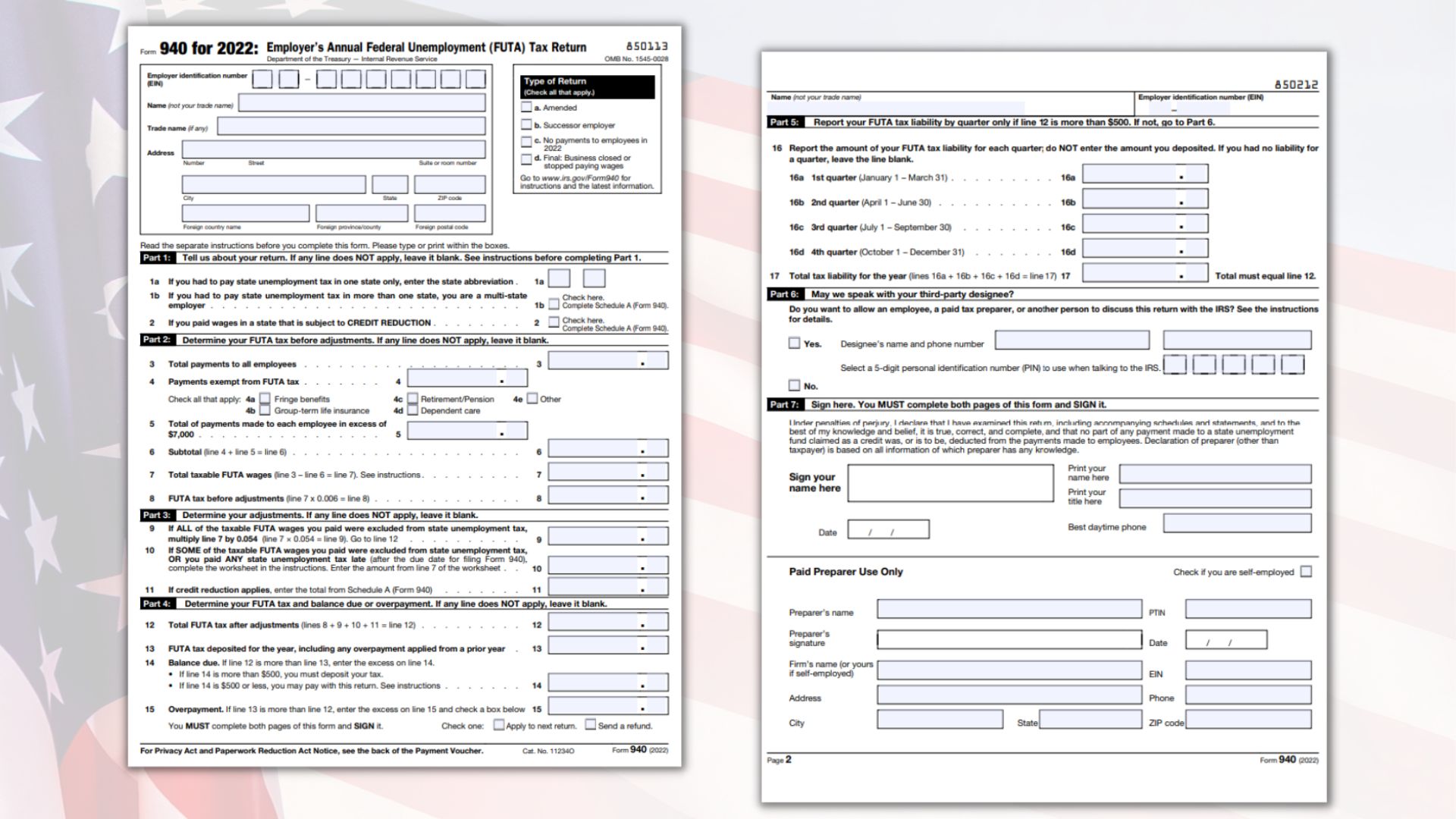

940 Printable Form - Be sure you have made all your unemployment tax payments for all states where your business is located before you print. Select back to form to get back to the main form. Select any any line or box for irs instructions and quickbooks information and troubleshooting steps. Use form 940 to report your annual federal unemployment tax act (futa) tax. Taxpayers use a form 940 for correcting a previously filed return by checking the amended return box in the top right corner of the form 940. File form 940 annually to report your annual futa tax. Form 940 is an irs tax form that employers use to report their federal unemployment tax (futa) liability on an annual basis. Irs form 940 is the employer’s annual federal unemployment tax return, filed separately from the form 941 employer’s quarterly tax returns. Efile your federal tax return now Form 940 is used to report annual federal unemployment tax act (futa) taxes and is filed once a year. If any line does not apply, leave it blank. Moving expense and bicycle commuting reimbursements are subject to. Efile your federal tax return now Please type or print within the boxes. Form 940, officially known as the employer’s annual federal unemployment tax return, is more than just another piece of paperwork — it’s a key part of how businesses. Be sure you have made all your unemployment tax payments for all states where your business is located before you print. Irs form 940 is the employer’s annual federal unemployment tax return, filed separately from the form 941 employer’s quarterly tax returns. Download or print the 2024 federal (employer's annual federal unemployment (futa) tax return) (2024) and other income tax forms from the federal internal revenue. Tell us about your return. In contrast, form 941 is used to report quarterly federal income tax,. Form 940, officially known as the employer’s annual federal unemployment tax return, is more than just another piece of paperwork — it’s a key part of how businesses. Use schedule a (form 940) to figure the credit reduction. You can electronically file most. Please type or print within the boxes. Form 940 (sp) available in spanish. Form 940 is a valuable and necessary document used by the irs to determine taxable futa wages from each business paying compensation to workers. We will use the completed voucher to credit your payment. All employers, including employers in puerto rico and the u.s. Taxpayers use a form 940 for correcting a previously filed return by checking the amended return. Taxpayers use a form 940 for correcting a previously filed return by checking the amended return box in the top right corner of the form 940. Please type or print within the boxes. Efile your federal tax return now Use schedule a (form 940) to figure the credit reduction. You can print other federal tax forms here. Be sure you have made all your unemployment tax payments for all states where your business is located before you print. For more information, see the schedule a (form 940) instructions or go to irs.gov. Form 940, officially known as the employer’s annual federal unemployment tax return, is more than just another piece of paperwork — it’s a key part. Taxpayers use a form 940 for correcting a previously filed return by checking the amended return box in the top right corner of the form 940. Form 940 is an irs tax form that employers use to report their federal unemployment tax (futa) liability on an annual basis. Be sure you have made all your unemployment tax payments for all. Form 940 is a valuable and necessary document used by the irs to determine taxable futa wages from each business paying compensation to workers. Together with state unemployment tax systems, the futa tax provides funds for paying unemployment. Moving expense and bicycle commuting reimbursements are subject to. If any line does not apply, leave it blank. Be sure you have. Together with state unemployment tax systems, the futa tax provides funds for paying unemployment. You can electronically file most. File form 940 annually to report your annual futa tax. Moving expense and bicycle commuting reimbursements are subject to. Select back to form to get back to the main form. Employers fill out this form each calendar year to remain within federal compliance. Be sure you have made all your unemployment tax payments for all states where your business is located before you print. Please type or print within the boxes. Download or print the 2024 federal (employer's annual federal unemployment (futa) tax return) (2024) and other income tax forms. This form is essential for calculating the. We will use the completed voucher to credit your payment. Employers fill out this form each calendar year to remain within federal compliance. All employers, including employers in puerto rico and the u.s. In contrast, form 941 is used to report quarterly federal income tax,. Employers fill out this form each calendar year to remain within federal compliance. Virgin islands, have the option to file form 940 (sp). Please type or print within the boxes. You can print other federal tax forms here. This form is essential for calculating the. In contrast, form 941 is used to report quarterly federal income tax,. Select back to form to get back to the main form. Be sure you have made all your unemployment tax payments for all states where your business is located before you print. This form is essential for calculating the. Virgin islands, have the option to file form 940 (sp). Form 940 is used to report annual federal unemployment tax act (futa) taxes and is filed once a year. Taxpayers use a form 940 for correcting a previously filed return by checking the amended return box in the top right corner of the form 940. You can electronically file most. We will use the completed voucher to credit your payment. Please type or print within the boxes. Select any any line or box for irs instructions and quickbooks information and troubleshooting steps. If any line does not apply, leave it blank. Together with state unemployment tax systems, the futa tax provides funds for paying unemployment. For more information, see the schedule a (form 940) instructions or go to irs.gov. Tell us about your return. Form 940, officially known as the employer’s annual federal unemployment tax return, is more than just another piece of paperwork — it’s a key part of how businesses.940 Form 2021 IRS Forms

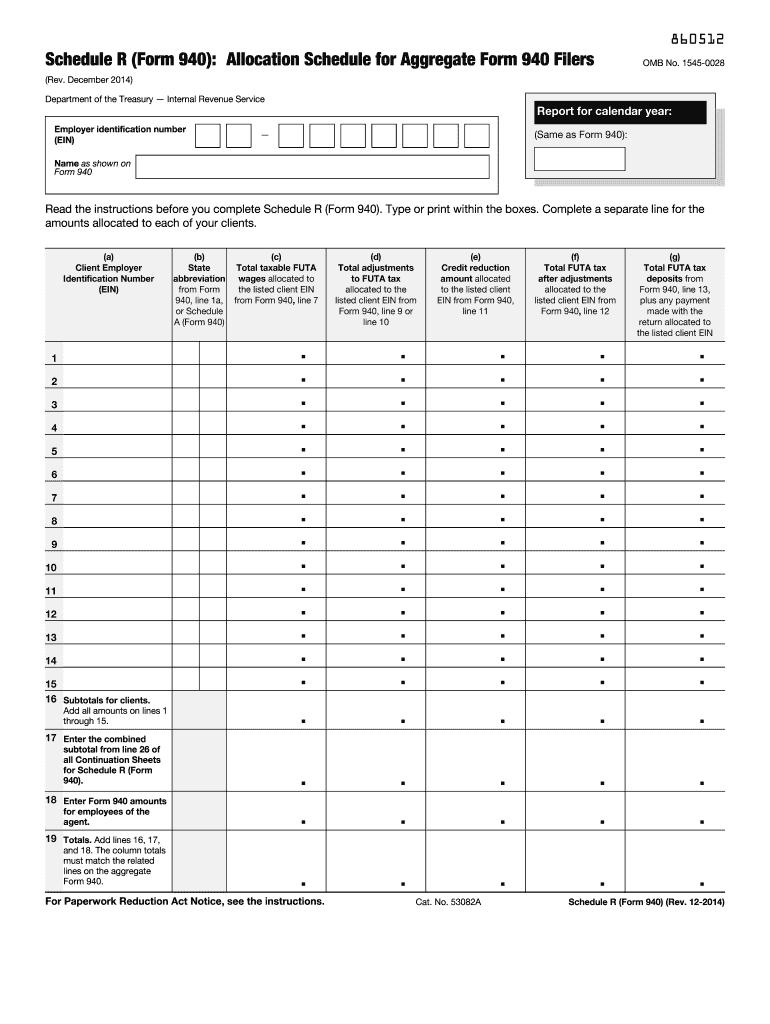

2014 Form IRS 940 Schedule R Fill Online, Printable, Fillable, Blank

Free Fillable Printable 940 Annual Form Printable Forms Free Online

IRS Form 940 for 2023 > Federal 940 Tax Form Printable Blank PDF With

What Is IRS Form 940?

Form 940 Edit, Fill, Sign Online Handypdf

Irs Form 940 Pdf Fillable Printable Forms Free Online

Irs Form 940 Pdf Fillable Printable Forms Free Online

IRS Form 940 PR 2018 2019 Fill Out And Edit Online Printable Form 2021

IRS 940 2019 Fill and Sign Printable Template Online US Legal Forms

Use Form 940 To Report Your Annual Federal Unemployment Tax Act (Futa) Tax.

Use Schedule A (Form 940) To Figure The Credit Reduction.

Employers Fill Out This Form Each Calendar Year To Remain Within Federal Compliance.

Form 940 Is An Irs Form For Reporting An Employer’s Annual Federal Unemployment Tax Liability.

Related Post:

:max_bytes(150000):strip_icc()/IRSForm940-2036a6d75e47453db1b2c5ffc3418919.jpg)